Why choose Lifetime Retirement Income?

You’ve worked hard for your money. Now, let Lifetime Retirement Income make your money work for you, so you can focus on enjoying your retirement.

Retirees face two key challenges when it comes to managing their finances:

- How do I generate an income to bridge the gap between NZ Superannuation and actual living costs? and

- How do I make sure my savings don’t run out before I do?

A Lifetime Retirement Income is the answer to both. We turn a lump sum from your savings into a tax-paid fortnightly income that arrives in your bank account on the same day as NZ Super. And we make sure your money will last a lifetime.

Project your income to see what you could receive.

How does Lifetime Retirement Income work?

You decide how much of your savings you’d like to invest in a Lifetime Retirement Income. We take care of the rest.

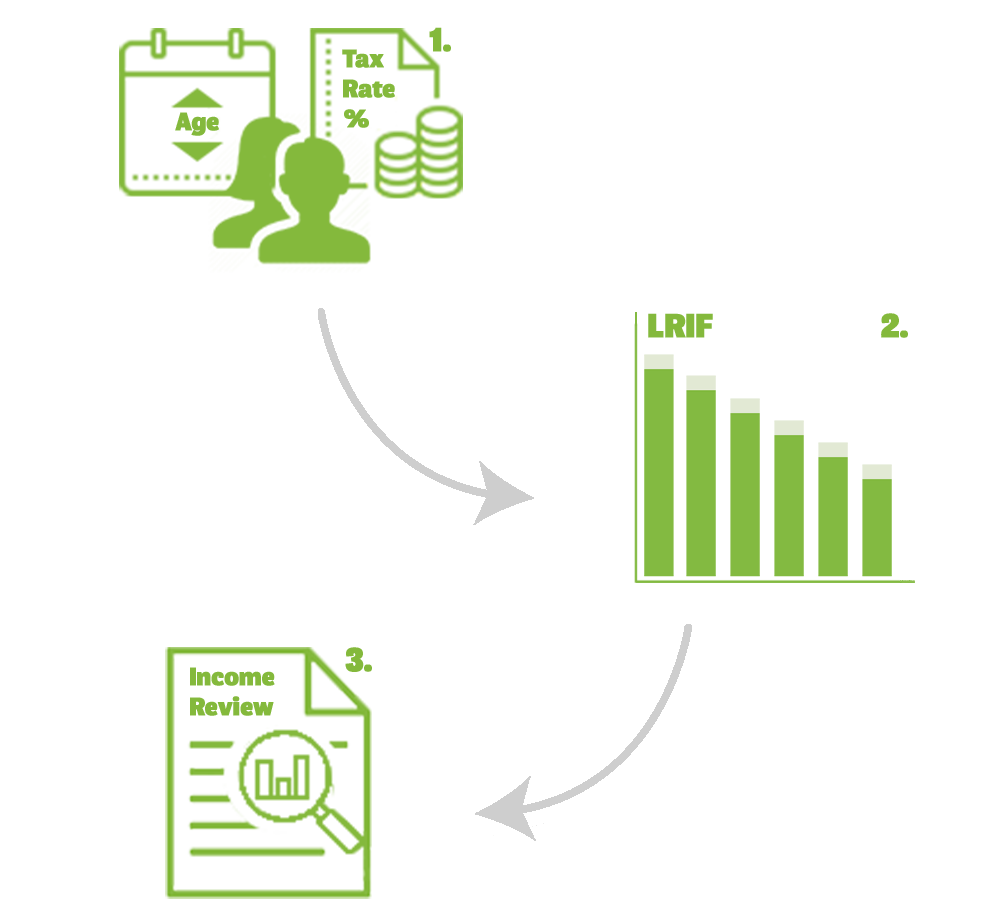

1. First, we calculate your Personal Annuity Factor based on key variables like your age, life expectancy, and tax rate, as well as inflation and expected investment returns. We use this to determine how much income you can safely draw down from your savings over the next year.

2. We then invest your lump sum in our Lifetime Retirement Income Fund (LRIF), which is designed to preserve capital over long timeframes. This means the fund invests in shares, bonds and cash like other mutual funds. However, it also employs a risk management strategy to smooth out the ups and downs of investing in financial markets, which gives us more confidence in long-term returns. This is crucial to making sure your regular, reliable income payments last as long as you do.

3. Each year we repeat step one, to make sure your retirement income plan is still on track to last your lifetime.

What you get when you join Lifetime

We manage the hard stuff, so you have the time and peace of mind to get on with the things that matter to you.

1. Your income is calculated

Based on your personal annuity factor, we then calculate the retirement income you can draw down every fortnight over the course of a year. Your annuity factor is based on your age, gender, tax rate, savings balance, and expected investment returns.

2. Your savings are invested

Your savings are invested in the Lifetime Retirement Income Fund and managed by our experienced investment committee. Your account balance, investment returns, and future payment details can be viewed anytime via your secure online portal.

3. Regular tax-paid income

Your income is comprised of a portion of your savings balance combined with investment returns and is paid to you each fortnight on Super Tuesday, providing you with an income to cover your day today expenses that you can be confident will last your lifetime.

4. Annual Income Review

Lifetime completes an Annual Income Review against the key annuity variables to ensure your balance remains sustainable over your lifetime. The review may result in adjustments to your retirement income which can be customised to meet your specific needs.

FAQs

How does Lifetime keep my savings secure?

Lifetime has built multiple layers of security to keep your savings safe. Firstly, your money remains yours, always. It is kept in a Public Trust bank account entirely separate from Lifetime’s operational accounts.

We are also regulated by the Financial Markets Authority, which means we adhere to strict obligations around supervisory oversight, reporting, disclosures and annual audits.

Our financial products themselves prioritise the security of our customers’ funds, while our team and board are highly experienced investment professionals driven by a sense of purpose and robust ethics. Click here to read a more detailed explanation of how we keep your retirement nest egg safe.

Can I make a partial or full withdrawal?

Unlike a Term Deposit, Lifetime ensures continuous access to your funds with no restrictions. The absence of minimum investment terms grants you the flexibility to initiate partial or full withdrawals at your convenience.

We don't impose withdrawal penalties, and the withdrawal process is quick and simple.

In retirement, unforeseen emergencies may occur, whether they involve medical issues, home repairs, or car problems. If you need to make a withdrawal, rest assured, we won't pry; your business is your business.

There is no limit on the number of partial withdrawals you can make, either. If you choose to make a partial withdrawal this will trigger an Interim Retirement Income Review.

Can we invest as a couple?

Yes! You can invest as an individual, or jointly with a partner. Joint investors must be in a relationship (i.e. de facto, civil union, marriage or a relationship determined by Lifetime to be similar in nature to those relationships).

The Annuity Factor for joint investors will be based on the person with the longest life expectancy however the highest PIR will be used, regardless of which investor has the higher rate. Click here for more information about joint accounts.

What happens to my investment if I pass away?

If you’re invested in an individual account, when you pass away your regular income payments will stop and the account balance will be paid to your estate. If you have a joint investment, regular income payments will continue to be paid, unchanged and uninterrupted, to the surviving partner..

Meet our Founder and Managing Director, Ralph Stewart

Why you’ll love a Lifetime Retirement Income

1. Regular Reliable Income

Ensure financial stability by receiving a reliable income every fortnight, aligned with NZ Super, to meet your ongoing expenses and bills.

2. Spend with Confidence

Enjoy peace of mind as we calculate an annual income that's designed to last your lifetime, allowing you to spend confidently without concerns about the longevity of your account balance.

3. Peace of Mind for Couples

In the event of one partner's passing, income payments continue seamlessly for the surviving partner, eliminating financial worries during a challenging time.

4. Tailored Flexibility

Benefit from the flexibility to adjust your annual income levels from one year to the next in response to your changing personal circumstances and financial needs.

5. More Time for What You Love

Simplify your finances as you age. Let our expert team handle the tough decisions, freeing up your time to focus on and enjoy the activities you love during retirement.

6. Maintain Control

Maintain control over your finances with the ability to withdraw part or all of your account balance at any time. Monitor your account balance through our secure online portal, providing clarity on your income schedule and account balance.

Hear from Lifetime customers

Hear from long-time customers Gwen and Bernard and Lynne, as they share how Lifetime Retirement Income helps provide peace of mind in their retirement.

Ready to retire with confidence?

Apply online today. Getting started is easy – just a few minutes online is all it takes!

Have a question? Our team is available to answer any of your questions. Reach out to our team at 0800 245 338. We're here to help.